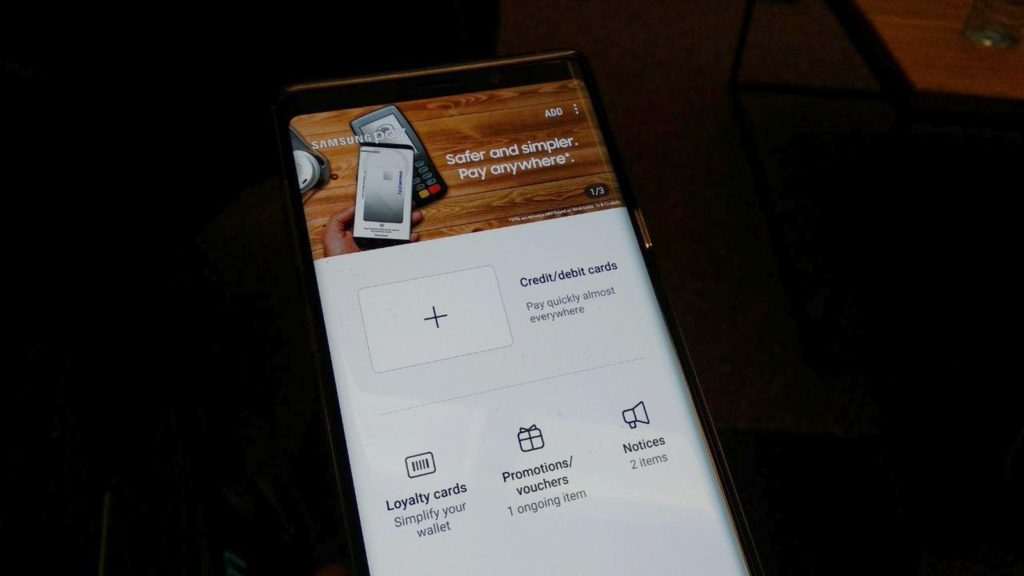

Samsung’s calling it a game changer. Banks are seeing it as a fresh avenue for payments. And users? Well, that remains to be seen.

What exactly is Samsung Pay?

No ad to show here.

For one, it this week launched in South Africa after years of waiting and testing. It’s now available to users of a select number of Samsung devices, allowing said users to pay for products wirelessly and without swiping any plastic.

But, there are a lot of questions we’ve been asked about the service. Here are a few answers to the most commonly queried FAQs.

How many cards can I enroll?

Seemingly as many as you fancy. Banks may suggest otherwise, but Pay doesn’t have an issue with holding more than one card. This also includes loyalty cards.

Which bank cards are accepted by Samsung Pay?

For now only ABSA and Standard Bank cards — debit, credit and cheque — are supported, along with three from other payment partners.

When will FNB, Nedbank and other banks’ cards be eligible?

Samsung, or the banks not supported, have yet to announce official dates of availability.

As for the reasons said banks are not yet supported is because they’ve yet to enable “the Visa and/or Mastercard tokenization implementation”, Samsung explains.

Tokenization is “a method of protecting payment card information by substituting the card’s number with a unique alphanumeric identifier, generated using proprietary algorithms,” Samsung notes in another FAQ.

“Samsung Electronics is working very closely with the other banks make Samsung Pay available,” the company adds.

What happens to my card if my phone is stolen?

Samsung explained that users can log in to its Find My Phone service from a desktop browser, disable the enrolled cards, wipe the smartphone remotely, and lock Samsung Pay. However, the service is still pretty secure.

You’ll still need authentication prior to processing any payments, even if your phone is stolen while it’s unlocked. You actually can’t use Samsung Pay without enrolling either your irises, a fingerprint or PIN number to the app.

Additionally, if your phone is locked, the thief would still need to break through your device security, making it more secure than if your credit card itself was stolen.

Finally, if your thief thinks they know your PIN number:

The user can make five attempts to unlock the application by authenticating with their fingerprint and/or Iris. After five failed attempts Samsung Pay will no longer accept a Fingerprint or Iris for authentication. The user will have 20 attempts to enter the correct PIN, thereafter all Samsung Pay data will be deleted and all linked cards will be deregistered.

All in all, you’ll still need to cancel your cards. Urg.

Which is the most secure authentication system?

Samsung notes that its iris scanners provide the best, most secure biometric authentication layer. During testing at the launch event this week however, we did find it to be buggy and unreliable at best.

Fingerprints and PIN numbers are the other two methods provided.

What tech does Samsung Pay actually use to pay?

Depending on the terminal, the service either uses MST — magnetic secure transmission — or NFC — near field communication.

NFC is a pretty common communication medium, developed in the early 2000s, and used today on the likes of the Gautrain and MyCiti cards. It’s also used in tech like Android Beam to transfer data across two devices.

MST effectively turns your smartphone into your bank card by reproducing the magnetic field normally generated when swiping a card at a terminal.

Can I use it if I have a third party launcher?

Yes. Even with Nova Launcher running, the ability to activate Samsung Pay from the home screen by swiping up from the navigation keys remains.

Additionally, the swipe-up action to activate Pay is only available from the home screen, not within any other app.

When is Samsung Pay’s rivals set to arrive in South Africa?

Huawei told us in an interview in April that South Africans should expect Huawei Pay to launch in the “second half of 2018”.

There’s no indication that Google or Apple are bringing their payment services to the country.

Fitbit Pay and Garmin Pay are also available in the country, launching to FNB clients using the smartwatches in June 2018.

What smartphones support Samsung Pay?

As of March 2019, the following Samsung Galaxy smartphones and wearables are supported:

- S10+/S10/S10e

- Note 9

- Note 8

- S9/S9+

- S8/S8+

- S7/S7 edge

- A8 (2018)

- A7 (2017)

- A5 (2017)

- Galaxy Watch

- Gear S3 Watch

- Gear Sport Watch

Have any other questions that we neglected to answer? Let us know.

Feature image: Andy Walker/Memeburn