Technology company Clickatell has launched Chat 2 Pay, a mobile service that lets businesses accept payments from customers via SMS or WhatsApp.

The service aims to offer a cost-efficient and convenient way for businesses to receive payments.

No ad to show here.

At the same time, customers do not need to disclose bank account or card details to those they do business with. This reduces the chance of fraud.

It also provides an answer to in-person proximity concerns during the COVID-19 pandemic.

“Chat 2 Pay addresses today’s boom worldwide in digital payments – a shift in consumer behaviour and response to the impact of the pandemic,” Clickatell CEO, Pieter de Villiers, said in a statement.

Born in South Africa, De Villiers co-founded Clickatell in 2000. The company is based in Silicon Valley in the US and has offices in Nigeria, Canada, and Cape Town.

“By taking the payment capabilities brands have on their websites, apps, and in their call centres, and making them available via chat, simpler payments will further drive adoption of this low-cost, efficient channel for interactions and transactions,” he explained.

How Chat 2 Pay works

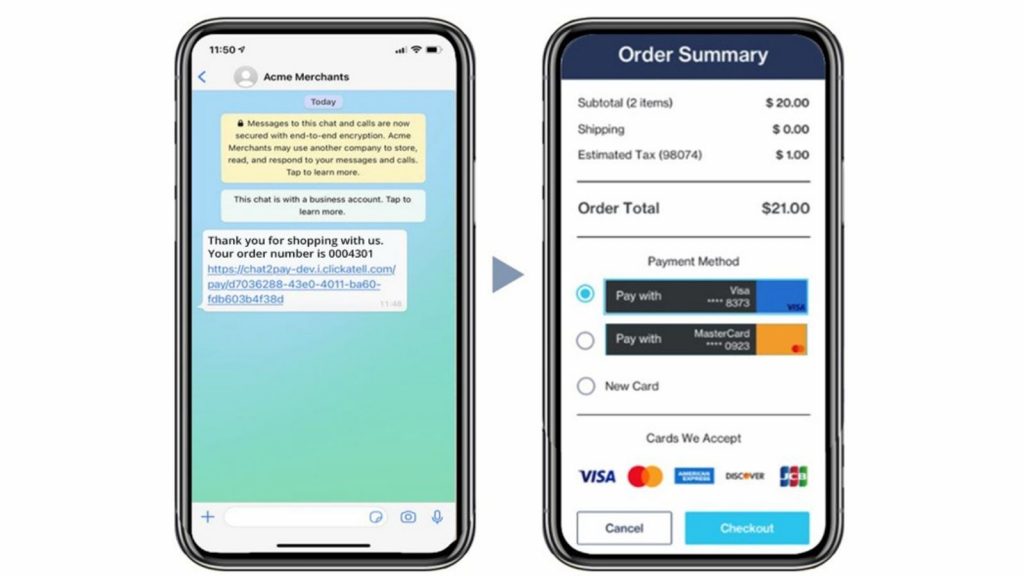

Using Chat 2 Pay, businesses can send a payment request from an Order Management System (OMS) to a customer in the form of a link.

Customers then receive the link on their mobile device via SMS or WhatsApp. After clicking it, it will direct them to a hosted checkout page.

They can then add their details and submit the payments. After that, they will receive confirmation and a receipt via the same chat channel.

Clickatell published a video that demonstrates Chat 2 Pay.

You can check out the video below:

Read more: Standard Bank launches Unayo mobile money platform

Feature image: Supplied/Clickatell