Anthropic says its AI will not be used to spy on customers, even in government contracts. Here is what that means for AI governance, enterprise trust and defence partnerships.

App of the week: Money IQ

![]() This week I take a look at Money IQ, a personal finance app that has quickly taken my app world by storm and become an essential part of my daily life.

This week I take a look at Money IQ, a personal finance app that has quickly taken my app world by storm and become an essential part of my daily life.

A couple weeks back I reviewed Moneybook, another personal finance app that I loved for its simplicity and beautiful design. You’ll recall though that I did have one or two issues with the app, one being the fact that it didn’t allow you to create your own categories (which has now been changed in the last update), and the other being the way it dealt with income – not well.

So naturally, being the app junkie that I am, I’ve been looking for something to knock Moneybook off my home screen for a while now, something that would satisfy my every personal finance desire and look good at the same time. That app is Money IQ.

So naturally, being the app junkie that I am, I’ve been looking for something to knock Moneybook off my home screen for a while now, something that would satisfy my every personal finance desire and look good at the same time. That app is Money IQ.

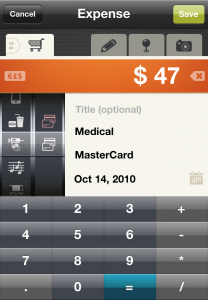

Starting off with Money IQ is a little daunting at first because of all the features and its innovative UI design. I must say that it took a bit of getting used to, but after about ten minutes of playing around with transactions at Aston Martin and over-the-top salary figures, I figured it out.

The app’s main screen is the budget screen. The top half provides you with real-time personal finance statistics like your top spending categories, your average daily spends and grand totals for the month. The bottom half is where you enter your transactions. This is where Money IQ triumphs over all other personal finance apps that I’ve used: once you’ve setup your accounts (cheque, savings, credit card and even your wallet) Money IQ adds beautifully designed logos to the bottom half of the screen. To add an expense, simply tap on the logo of the account being drawn from in the spend bar, to add an income, tap the icon of the account being credited in the income bar (it has a little plus sign).

The app’s main screen is the budget screen. The top half provides you with real-time personal finance statistics like your top spending categories, your average daily spends and grand totals for the month. The bottom half is where you enter your transactions. This is where Money IQ triumphs over all other personal finance apps that I’ve used: once you’ve setup your accounts (cheque, savings, credit card and even your wallet) Money IQ adds beautifully designed logos to the bottom half of the screen. To add an expense, simply tap on the logo of the account being drawn from in the spend bar, to add an income, tap the icon of the account being credited in the income bar (it has a little plus sign).

The app will then allow you to choose a category, enter the amount, add a small description, take a picture of the receipt (great for accounts and business expenses) and even geo-tag the transaction, great for those nights out where you wake up with an empty wallet and cant remember where you spent all your money!

The app will then allow you to choose a category, enter the amount, add a small description, take a picture of the receipt (great for accounts and business expenses) and even geo-tag the transaction, great for those nights out where you wake up with an empty wallet and cant remember where you spent all your money!

A clever feature that Money IQ has that others don’t is the inter-account transfer option, it even lets you add transfer fees – although with our banks, these change all the time and differ according the amount transferred, so I just wait until the end of the month and enter one giant transfer fee to cover them all.

Money IQ is extremely intuitive and allows a lot of customization for the user. The settings page allows you to add new categories, delete redundant categories, and even choose the default category and account for your expenses (this helps a lot if you’re pretty set in your way with your spending). Another clever feature that I like is the way that you can customize the order of your categories, this is pretty useful as it can help to cut down time spent recording transactions.

As I mentioned earlier, Money IQ has one of the most innovative UI’s and designs that I have seen on an app. They really have made use of all that the iPhone offers when it comes to app interaction, without getting too intricate or over the top. Categories can be scrolled through and matched up with account icons when entering a transaction, the colours all look great on the retina display screen, and the app loads quickly, no matter what you throw at it.

As I mentioned earlier, Money IQ has one of the most innovative UI’s and designs that I have seen on an app. They really have made use of all that the iPhone offers when it comes to app interaction, without getting too intricate or over the top. Categories can be scrolled through and matched up with account icons when entering a transaction, the colours all look great on the retina display screen, and the app loads quickly, no matter what you throw at it.

The reports are also beautiful and easy to use. You can either take a look at the standard doughnut chart with the date at the bottom, or swipe right to see it in bar graph fashion. More complex and filtered reports can also be setup and viewed. Budgeting is also a breeze with Money IQ, simply set your budgets up according to category and time period, and allow the app to monitor your spending for you, its that easy.

At $4.99 some might say that it is a bit pricey, but you can check out the lite version first (search for Money IQ lite), it allows you to perform 100 transactions before you have to upgrade. Don’t worry about losing your data though, the lite version has an upgrade option that exports all your data into the new unrestricted app.

Money IQ is truly an undiscovered gem in the app store. Where other apps over-complicate and disappoint or over promise and under deliver, Money IQ does everything that you’d ever want a personal finance app to do.

Name: Money IQ

Publisher: Sperasoft, Inc.

Category: Finance

Price: $4.99

Size: 7.9 MB

Available for iPhone