With stablecoins gaining traction and regulation improving, African merchants may be nearing a crypto tipping point. Here’s why 2026 could mark a shift from hesitation to adoption.

Worldwide PC shipments are slowing, still managed 1.9% growth in Q1

There’s life in the PC market yet, or is there?

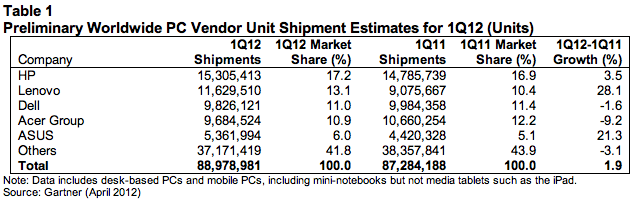

Research company Gartner says 89 million PCs were sold in the first quarter of 2012. That’s a 1.9 percent increase from the first quarter of 2011, when shipments reached 87.3-million units.

“The results were mixed depending on the region, as we saw the EMEA region perform better than expected, while Asia/Pacific performed below expectations, in part because of slow growth in India and China,” said Mikako Kitagawa, principal analyst at Gartner. “While the PC industry has high expectations for strong growth in the emerging markets, the slowdown of these countries in this quarter provides a cautionary notice to vendors that the future growth for the PC industry cannot heavily depend on the emerging markets even though PC penetration in these regions is low.”

The research company reckons the worldwide hard drive shortage had a limited impact on PC sales and that demand wasn’t actually high enough for it to become an issue.

Typically, first quarter PC sales are weaker, but Gartner’s preliminary results indicate slower than normal PC shipment growth. Very simply, beyond PCs, the market is presenting consumers with more compelling gadgets to spend their money on. Companies with a diversified product offering such as Apple fare better.

HP is still the market leader and it accounted for 17.2% of worldwide PC shipments in Q1 of 2012. The American manufacturer seems to have sorted out its management and HDD inventory issues.

Lenovo showed the most growth with shipments increasing 28.1% in the first quarter of 2012.

For the first time in two years, Dell experienced a year-on-year shipment decline in the Asia/Pacific market. Gartner thinks that’s because Dell focused on enterprise and neglected to give priority to budget consumer PCs.

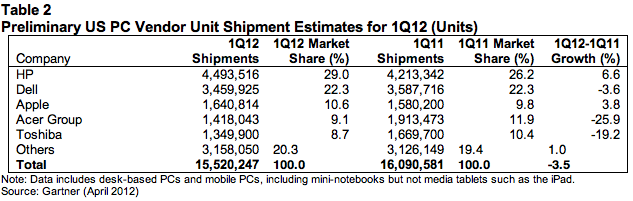

In the US, PC shipments declined 3.5 percent from the same period last year, totaling 15.5-million units in Q1 of 2012.

“The consumer segment continued to be a drag on market growth, as PC demand was low,” Kitagawa said. “The HDD supply shortage moderately impacted the very low-end consumer notebook market, so channels could not run aggressive promotions with very low-end systems. Questions remain on whether low-end systems can attract consumers, as their attention has moved to other devices.”

HP won the most ground in the US, with its PC shipments increasing by 6.6 percent and its market share reaching 29% in the quarter. Apple performed second best, its shipments increased 3.8 percent.

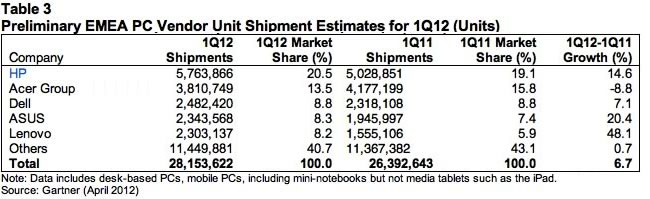

Despite an overall weak PC market in 2011, PC shipments in the EMEA region totaled 28.2-million units in Q1 of 2012. That’s a 6.7 percent increase from the same period.

“The EMEA PC market grew faster than the worldwide PC market because of solid demand from the professional market as organisations executed long-awaited Windows 7 plans,” said Ranjit Atwal, research director at Gartner. Demand came from Western Europe as well as emerging markets, and it strengthened the desk-based PC market. Gartner estimates that the EMEA desk-based PC market will account for 40% of total PC shipments in 2012. “The desk-based PC isn’t dead yet,” Atwal added.

There was also improved demand from Russia and members of the Commonwealth of Independent States, and more modest upturns in other Central and Eastern European countries.

In Asia/Pacific, PC shipments reached 30.3 million units in Q1 of 2012. That’s a 2 percent increase from Q1 of 2011. Gartner says the termination of a rural PC program caused shipments of desktop PCs to decrease significantly in China.

PC shipments in Latin America totaled 9 million units. That’s a decline of 3.2 percent. Mobile PC shipments grew 0.4 percent over Q1 of 2011, while desk-based PC shipments decreased 7.6 percent. Many non brand name PC vendors had depleted inventory due to the HDD shortage.

In the land of the rising sun, PC shipments rose 11.5% in the first quarter of 2012, as shipments reached 4.4 million units. Japan’s double-digit growth was due in part to the very weak performance in the first quarter of 2011, which was affected by the earthquake and tsunami in Japan in March of last year.

“The first quarter of 2012 was a transitional period as the PC industry is awaiting two big releases: Intel’s Ivy Bridge and Microsoft’s Windows 8. Both are expected to be launched this year. Although these new releases are not expected to stimulate demand as much as the industry hopes, they will affect PC supply so that there will be artificial supply control before and after the product releases. There will be few products rolled out into the market until these major releases have taken place,” Ms Kitagawa said.