With powerful hardware working together with an industry-leading camera system and intuitive AI experiences, everyday tasks have never been easier and faster

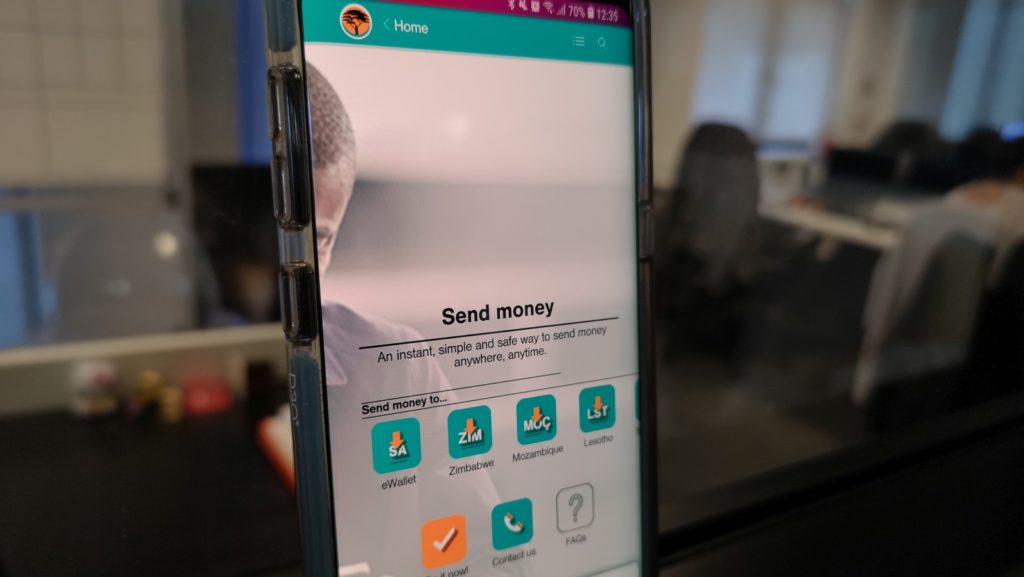

FNB launches eWallet eXtra mobile bank accounts in South Africa

First National Bank has today announced eWallet eXtra, a digital bank account that can be opened from a mobile device for unbanked South Africans.

According to FNB, the mobile bank account is intended to plug the gap between its eWallet offering and traditional bank accounts that “do not meet the unique needs of irregular income earners such as seasonal workers.”

FNB suggests that this target market consists of some 11-million South Africans. The eWallet eXtra offering does attempt to plug this gap.

“If you are above the age of 16 and own a cellphone, you’ll be able to get a mobile bank account with a unique account number in less than three minutes, and you don’t need a bank card to transact,” notes Gugu Zikhali, FNB’s head of transaction products.

“eWallet eXtra will enable users to send or receive deposits from individuals and other banks, store funds for an unlimited period, pay accounts and also buy prepaid products like airtime, data and electricity.”

It will also function similarly to a traditional bank account.

FNB will let users view balances and transaction histories from their phones and secure their account with a PIN number. There are also no monthly banking fees, and access to the service will also be free for those using FNB SIM cards.

Keeping with its mobile-centric theme, users can also send money to other eWallet eXtra users, or draw money at a select number of Spar stores. “The daily spend limit is R3 000 and R24 000 per month,” Zikhali adds.

Users of FNB’s eWallet eXtra however will not be able to debit from the account, so paying for services like Netflix or Google apps will not be possible.

The offering will be available to the public from June 2018.

Feature image: Memeburn