With youth unemployment above 60 percent, South Africa is betting on digital skills to drive inclusive growth. Here is how MICT SETA is positioning the next generation for the Fourth Industrial Revolution.

Black Friday 2020 in South Africa breaks spending records

The e-commerce industry in South Africa has experienced a boom since the start of the COVID-19 pandemic — and Black Friday was no exception.

According to PayFast, Black Friday saw a 50% increase in spending patterns this year.

The payment solution company also says that it processed a 283% increase in total payment volumes, compared to a normal peak such as payday.

This comes even after most retailers extended their Black Friday offerings across the entire month of November, instead of containing it to a single weekend.

“This year’s Black Friday spend surpassed the volumes we’ve seen in previous years. The rapid adoption of e-commerce over the course of 2020 has meant that we’ve seen more people shopping online, especially amid fears of a COVID-19 resurgence,” says Jonathan Smit, Managing Director and Founder of PayFast.

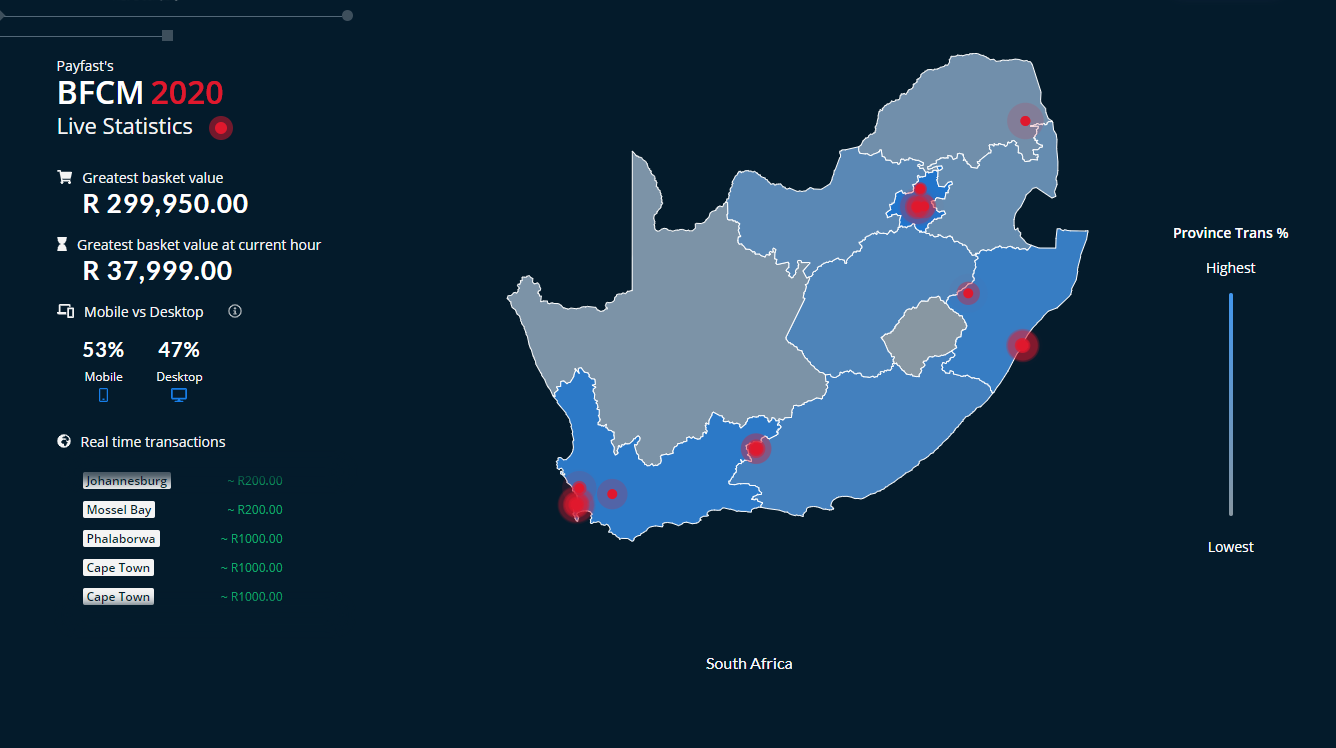

Black Friday 2020 spending, according to PayFast

The highest transaction for this year’s Black Friday in South Africa was R299 950.

The company also found that online shoppers spent more per basket on Black Friday with an average of R1 243; compared to the 2020 average basket value of R803.

“Alongside big-ticket items like TVs and gaming consoles, more purchases were made online for items that are traditionally brick-and-mortar, retail-store focused, like toiletries, cosmetics, and essentials,” says Smit.

True to buyer trends seen during South Africa’s harder lockdown stages, 66% of purchases came from a mobile device.

“Smartphone usage means you can shop literally from anywhere, any time. We’re seeing merchants and payment methods better cater towards the demand for mobile too,” says Smit.

Over the past six months, retailers have invested in upgrading their online platforms to offer better user experiences for first-time shoppers. However, the e-commerce industry did face hurdles, including courier delays.

“This Black Friday offered a more considered and improved customer experience across the board. Lockdown was a good test for many e-commerce businesses, with lessons carried into this peak period,” says Smit.

This year, 66% of transactions were made using cards. But alternative online payment options are also on the rise.

“Instant EFT, QR codes, and mobile wallets are becoming more popular as consumers become more comfortable shopping online,” says Smit.

If you’re keen to track the developing statistics on today’s Cyber Monday spending patterns, you can check it out here.

Feature image: Photo by Karolina Grabowska from Pexels.com

Read more: Cape wine farm adapts to pandemic with virtual wine tastings, tours