Anthropic says its AI will not be used to spy on customers, even in government contracts. Here is what that means for AI governance, enterprise trust and defence partnerships.

How SARS’ auto-assessments work

With tax season open, many taxpayers in South Africa will be receiving their auto-assessments from SARS. While a few things have changed with these assessments, they’re meant to make the tax filing process easier.

But how does SARS determine the refund or owed tax on an auto assessment? Who receives these assessments?

Here’s a look at some of the most common questions surrounding auto-assessments and their answers.

Who will receive auto-assessments from SARS?

Auto-assessments are sent to people whose taxes are considered “less complicated” by SARS. This means that if you’re a taxpayer with multiple sources of income and who’s self-employed, you’re unlikely to get an automatic assessment. This is because SARS needs you to add income that doesn’t have an IRP5 to your filing, as well as potential deductions for conducting business.

But if you’re someone who receives income from a single employer, and doesn’t earn rental income or investment returns, you’re more likely to receive this type of assessment.

One benefit of this assessment is that you won’t be selected for audit or verification unless you submit a new filing.

How does SARS calculate your return?

SARS uses documents such as IRP5 or IT3(a) forms from employers and tax certificates from your medical scheme, bank, and retirement annuity fund to make an assessment.

If these are the only documents you would usually submit, you’re less likely to need to adjust your assessment.

However, if you have further deductions or data relevant to your return, you should adjust the filing on SARS eFiling or the MobiApp.

How long do you have to change your auto-assessment?

If you believe the calculation for your return is incorrect, you have 40 business days to file an amended return. To do this, you need to log into SARS’ online eFiling platform or the SARS app.

This is particularly important if you have deductions that weren’t included in the original assessment. For example, if you have home office expenses. But this also applies to people with disabilities or physical impairments (or who have dependents with these conditions) that need to deduct the cost of treatments, caregiver services, or assistive devices.

You don’t have to raise an objection to change your return. Rather, you just need to access your return, adjust the relevant section, and file it again.

If SARS accepts these changes, it will issue an adjusted assessment.

How to verify your SARS auto-assessment

If your assessment seems correct, but you want to verify the information, you can do so on eFiling.

SARS gives the following instructions to verify information and certificates it has received:

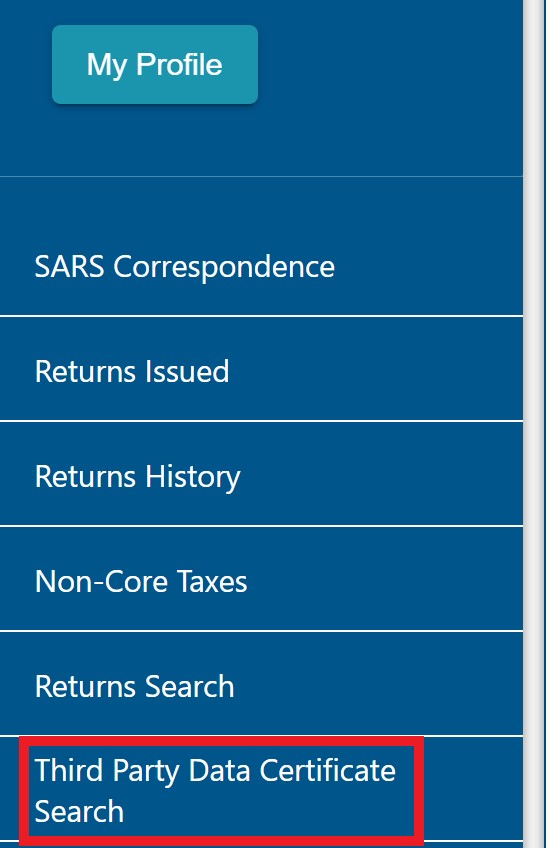

- Log into your eFiling profile.

- Select the “Third Party Data Certificate” search button on the menu bar.

- Search any certificate that you wish to verify.

- Select the certificate type in question.

You can then see if these documents match your own.

If there is an error, you should request a correction from the party that supplied SARS with this information (for example, your medical aid). You can then update the document on eFiling or the SARS app and file the return.

If you’re happy with your auto assessment, you’re done, but if you would like to amend your auto assessment, file an amended income tax return within 40 working days of receiving your auto assessment. More information: https://t.co/HsnW2pauSk #YourTaxMatters pic.twitter.com/s2JgyyKTmo

— SA Revenue Service (@sarstax) July 22, 2022

If you accept your assessment, you don’t need to do anything after logging in to view the final total for your refund or tax owed. If you are due a refund, you will receive it in 72 hours if your banking details are on your profile.

To find out more about the intricacies of the auto-assessment process, you can visit the SARS website.

Read more: SARS warns of scammers stealing tax refunds through eFiling profiles