Inbox icons, subject line sorcerers, CTA kings – the results are in. The 2025 You Mailed It Awards by Everlytic have crowned their champs, with Old Mutual Rewards and Machine_ taking…

Apple Pay later feature now here, here’s how it works

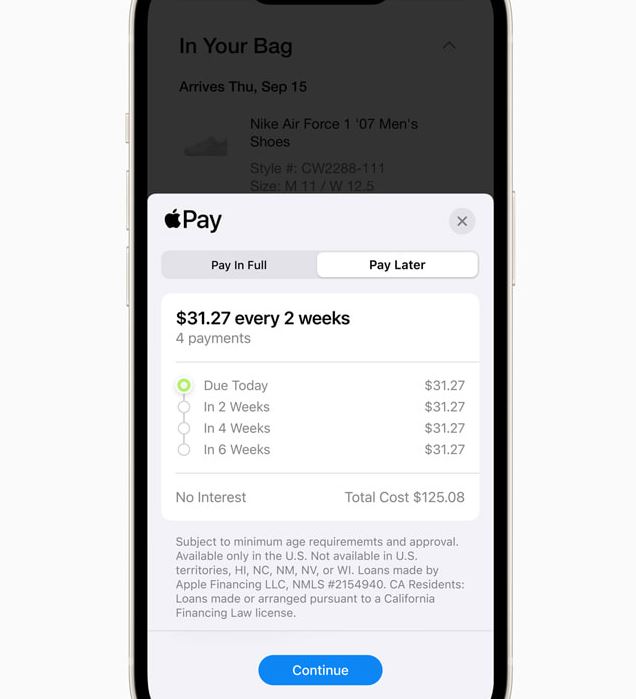

Split Apple payments into four payments with Apple Pay later at zero interest and no other fees.

The delayed feature which was meant to arrive sooner was introduced in the US on Tuesday.

Apple said the feature is designed with user financial health in mind as it will allow users to split purchases into four payments, over six weeks with no interest and no extra fees.

Apple users will be able to pay their Apple Pay later loans in one convenient location – Apple Wallet.

“Users can apply for Apple Pay Later loans of $50 to $1,000, which can be used for online and in-app purchases made on iPhone and iPad with merchants that accept Apple Pay.

Apple initially plans to offer the plan to select users first, with room to offer the plan to eligible users there after.

Loans, a wallet and Pay later

Apple’s system is basically allowing users to take something on credit.

Users can apply for a loan within Wallet with no impact to their credit.

I wonder what happens when users can’t pay, if this will still not impact their credit.

Users will be prompted to enter the amount they would want to borrow while agreeing to Apple Pay later terms stipulated.

“A soft credit pull will be done during the application process to help ensure the user is in a good financial position before taking on the loan,” said Apple in their blog.

Access to information

Once a user is approved, they will be able to see the Apple Pay Later option in order to make a purchase.

Users can also apply for a loan director in the checkout flow when making a purchase.

The system is offered by Apple Financing LLC, a subsidiary of Apple Inc, responsible for all credit assessment and lending.

Apple financing plans to report Apple Pay later loas to the U.S. credit bureau stating any failed payments.

Apple Pay will use authentication features such as FaceID , Touch code or even passcode for privacy and security.

- With Apple Pay Later in Wallet, users can easily see the total amount due for all of their existing loans, as well as the total amount due in the next 30 days.

- They can also choose to see all upcoming payments on a calendar view in Wallet to help them track and plan their payments.

- Before a payment is due, users will also receive notifications via Wallet and email so they can plan accordingly. Users will be asked to link a debit card from Wallet as their loan repayment method, to help prevent users from taking on more debt to pay back loans.

Also read: iPhone 15 and the Sim card slot, is it staying or going?