Unlock up to 10,000 USDT with the best MEXC referral code, mexc-NFTP. Learn how to claim bonuses, reduce trading fees, and earn rewards for deposits and trades.

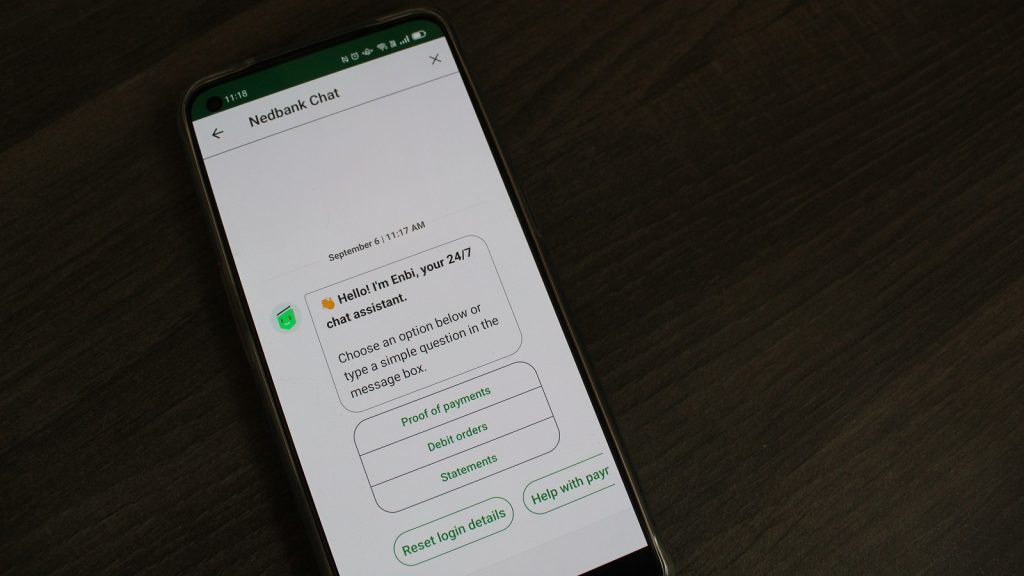

Nedbank launches chatbot and other digital features

Nedbank has launched several new features that aim to improve their customers’ digital experience, including a new conversation chatbot.

The chatbot, named Enbi, is available on the bank’s Money app and online banking web portal.

“Enbi is set to raise the bar when it comes to the value that digital assistants can bring to customers when managing their finances,” Programming Executive for Digital Fast Lane at Nedbank, Ravikumaran Govender, said in a statement.

What can the Nedbank chatbot do?

Enbi can direct users to features in the app and web portals and respond to queries about Nedbank’s products and services.

It can also guide users on how to perform tasks such as reversing a debit order or finding their nearest bank branch.

Clients use it by typing in simple questions or by selecting one of the available options.

“One of the challenges with banking apps is that it can take time to find the various features that the customer is able to use,” Govender explained.

“Enbi helps by understanding what the customer is looking to achieve and either giving them the information or guiding the customer to the right function.”

Other new digital features

Alongside the chatbot, Nedbank also announced a new cardless withdrawal facility for clients to send money to recipients.

Using the facility, people can withdraw cash from Nedbank ATMs and select retail stores using a secure voucher number and one-time password. The retails stores include OK, Checkers, Shoprite, and Usave.

Recipients do not need to be Nedbank clients to use the facility.

Nedbank also announced a new service for clients to register for cellphone banking.

Previously, clients who wanted to sign up for the mobile platform had to visit a bank branch to do so.

Now, clients can dial *120*001# and register using either their card details or the traditional profile and PIN process.

Once completed, they will receive a five-digit banking PIN that lets them access the mobile platform.

In July, Nedbank launched a free online Moneytracker tool that lets its personal and business clients track their finances. The tool is also available via the bank’s digital platforms.

Read more: Shoprite Money Market launches instant EFTs

Featured image: Memeburn/Sam Spiller