Bitcoin has surged to its highest level in a month as global risk sentiment improves and Donald Trump signals renewed support for the crypto sector.

What is Northvolt worth for German car companies?

Northvolt needs $1.2bn to continue operations. It’s a telling number after the Swedish battery manufacturer secured $15bn in funding, which has delivered none of its promised battery capacity.

Building a battery production facility in Europe seemed like a visionary and potentially profitable vision back in 2015. In the year Northvolt was founded, VW’s diesel emissions scandal altered the projections for Europe’s automotive industry. Diesel would die, and EVs would become the powertrain of choice for European car markers into the 2020s and beyond.

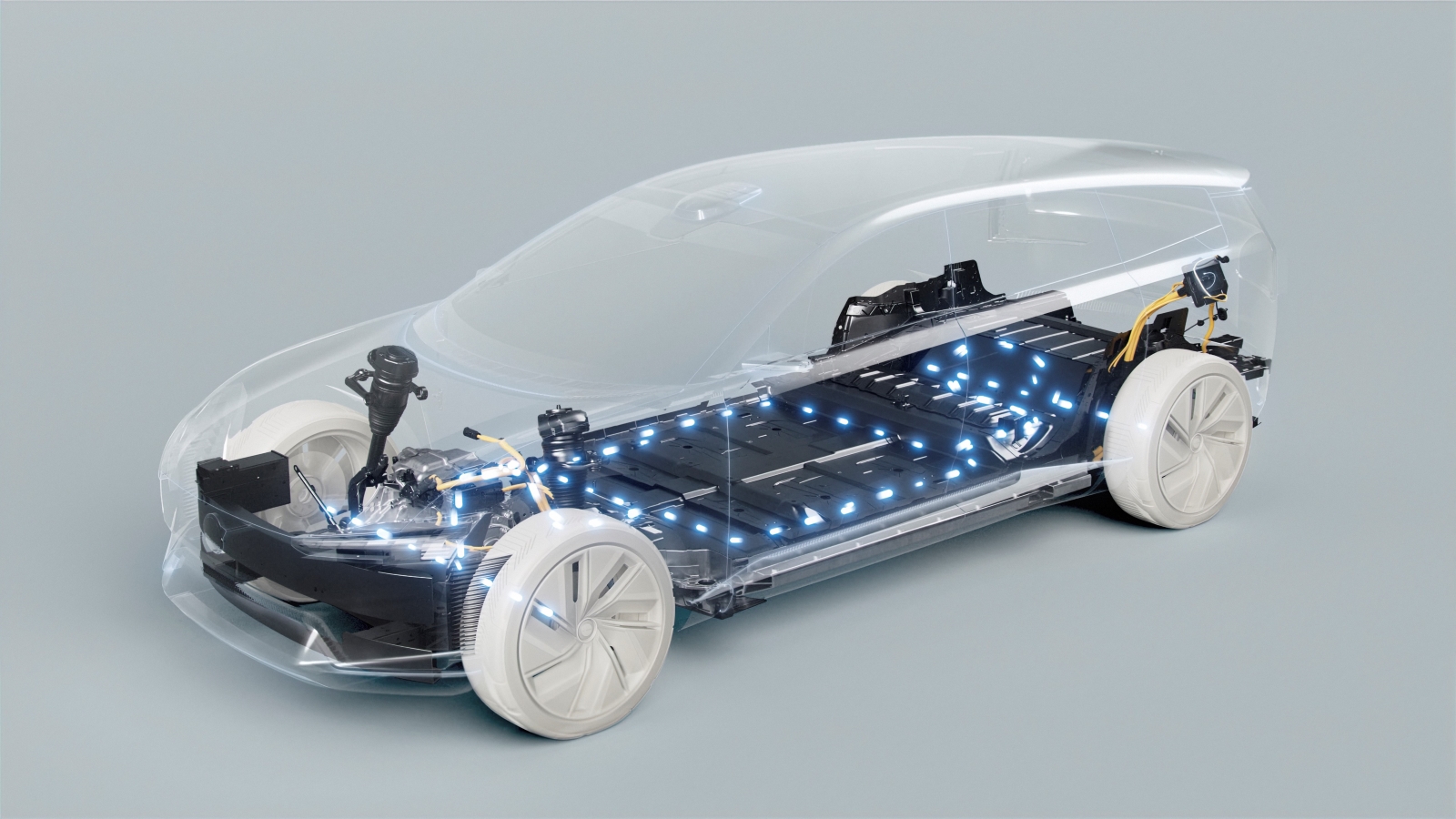

Securing lithium-ion battery packs at the scale, quality, and energy density required for automotive applications would be an enormous challenge for European car companies. The solution was Northvolt.

Northvolt was the clean battery future

Based in Sweden, Europe’s new Gigafactory would have access to all the skills and clean energy possible, enabling it to deliver EV batteries to German car companies desperate to diversify away from Chinese battery sources. VW and BMW were keen early investors and customers.

How has a company with such a vision, solving a real powertrain crisis for European car companies, become bankrupt?

This is a moment of reckoning for the European car companies and their lofty promises of progressively more EV-aligned product portfolios. Dependency on imported Chinese batteries places European car companies, especially in Germany, under significant cost pressure. It also creates supply chain fragility if another trans-Pacific trade conflict ignites between the US and China.

Demand or supply problems?

With VW championing the cause of EVs, by investing massively in its MEB platform and BMW and Mercedes-Benz adding several new EV models, battery demand was going to be huge. Or was it? BMW cancelled its Northvolt contract in June, foreshadowing how narrow EV demand and future production optimism have become.

Northvolt produced its first battery in 2021, when EV marketers and European policymakers were extremely bullish on EV sales. The reality is that there has been a dearth in the demand for passenger vehicle EVs, especially as energy prices and inflation surge throughout Europe.

EV sales have not met projections, and that’s a huge problem in the car industry. Powertrain suppliers gear their production for future demand to fulfil commitments to customers. When a specific model underperforms massively in the market, it creates a complete mismatch between supply and demand – with the supplier usually taking the risk.

Battery diversity is difficult

Although ideally positioned to supply Europe car markers, did Northvolt have the correct matrix of technologies? Following its bankruptcy announcement this week, the company’s industrial engineering and management will be scrutinized.

China’s dominance in automotive-grade EV batteries is not accidental. Skilled battery assembly technicians, chemists, and industrial engineers work demanding hours for much lower wages than in Europe, creating tremendous scale and efficiency at Chinese battery companies.

Technically, Chinese battery companies have had two or three decades to master their processes. As China became the global manufacturer of choice for consumer electronics, it gained an enormous advantage in scale and skill regarding battery technology and production.

Before any car companies cared about lithium or sodium battery chemistries at scale, Chinese battery specialists perfected them in various form factors for diverse industrial and consumer applications. This invaluable product development expertise and experience…

Competing with China

Northvolt was visionary, but it’s almost impossible to compete with Chinese rivals on cost or technology in the automotive battery market. And that’s telling.

The Chinese battery story and its dominance are not just because of lower labour costs or enabling industrial policies. It’s the scale and experience of serving a huge electronics market and understanding how diverse chemistries, beyond lithium-ion, matter to different applications.

Did Northvolt have the vertical integration and assembly ingenuity to best China’s best battery companies? Those questions will now be asked, as Europe’s EV supply chain is dealing with its second significant battery factory failure in as many years, Britishvolt having been the market shock of 2023.

Automotive powertrain facilities must run at 85% capacity or above to be cost equivalent and sustainable. If Northvolt could only scale its production to 5% of installed build capacity by September this year, what was happening with tooling, machinery, staff and supply chain?

(Very) advanced batteries

The sodium-ion and lithium-metal cells prototyped by Northvolt have terrific energy density numbers. Those legacy Swedish chemistry skills were evident in its product development.

Operating on sustainable zero emissions power is a long-term production advantage and will only become more valuable in the future. This could make the Skellefteå factory a supplier of choice to circular supply and energy-sensitive European car companies.

Sweden has been a pioneering government and society regarding Europe’s green transition, from Greta Thunberg’s advocacy to engineering innovation. There are jobs, national prestige, and a sense of environmental destiny at stake, with Northvolt making it possible, if not probable, for the Swedish government to direct pension funds to rescue Europe’s biggest battery factory.

Who will save it?

Ironically, at a time when EVs should be making an impact, Europe’s most important Gigafactory is facing an uncertain future. Will a German car company be strategic and buy Northvolt’s Skellefteå factory? Even if they’d like to, could they?

A surge in EV R&D and supply chain costs, compounded by collapsing profits in China, have made it almost impossible for any of Germany’s larger car companies to take control of Skellefteå.

A turnkey Gigafactory is essential for European car companies to make EVs at the scale and profitability they need. This is exactly what the Skellefteå facility offers – ready for operations and tooled to produce high-quality automotive batteries for EU car companies.

Still, it is unlikely that BMW, Mercedes-Benz or VW AG can afford to rescue Northvolt. A German consortium making a bid to the Swedish government for Skellefteå? Stranger automotive industry joint ventures have happened…