Bitcoin has surged to its highest level in a month as global risk sentiment improves and Donald Trump signals renewed support for the crypto sector.

FNB’s new lifestyle partnerships and app offerings explained

FNB has extended its partnerships and app solutions further into the lifestyle sphere with the launch of new perks and services for customers.

The bank announced several new benefits, app features, and online services at an event last week.

“Our expanded lifestyle solutions demonstrate our commitment to delivering contextual innovations to our customers via our trusted digital platform,” Jacques Celliers, CEO of FNB, said.

“In keeping with our status of providing customers with the best value-added services in financial services, we are once again shifting into high gear in our efforts to offer customers exponential help. We are delighted to have like-minded partners as we are significantly scaling our unique ability to enable customers to manage both the financial and lifestyle facets of their lives by using the power of our integrated platform.”

Among these new lifestyle benefits is a free coffee partnership with Starbucks, discounted access to Udemy courses, access to the GuardMe panic button, the eBucks Games platform, and new FNB Connect deals.

Here’s a look at the new rewards available to FNB and RMB Private Bank customers…

FNB and Udemy courses

With the partnership between the bank and Udemy, customers will get discounted access to Udemy courses.

Udemy courses usually start from R219.99. But with the FNB partnership, customers can access over 400 courses from the platform for a R50 activation fee instead.

However, customers are limited to six courses per year.

You can access the benefit by using the FNB App and visiting the eBucks Partner tab. Under partners, select Udemy.

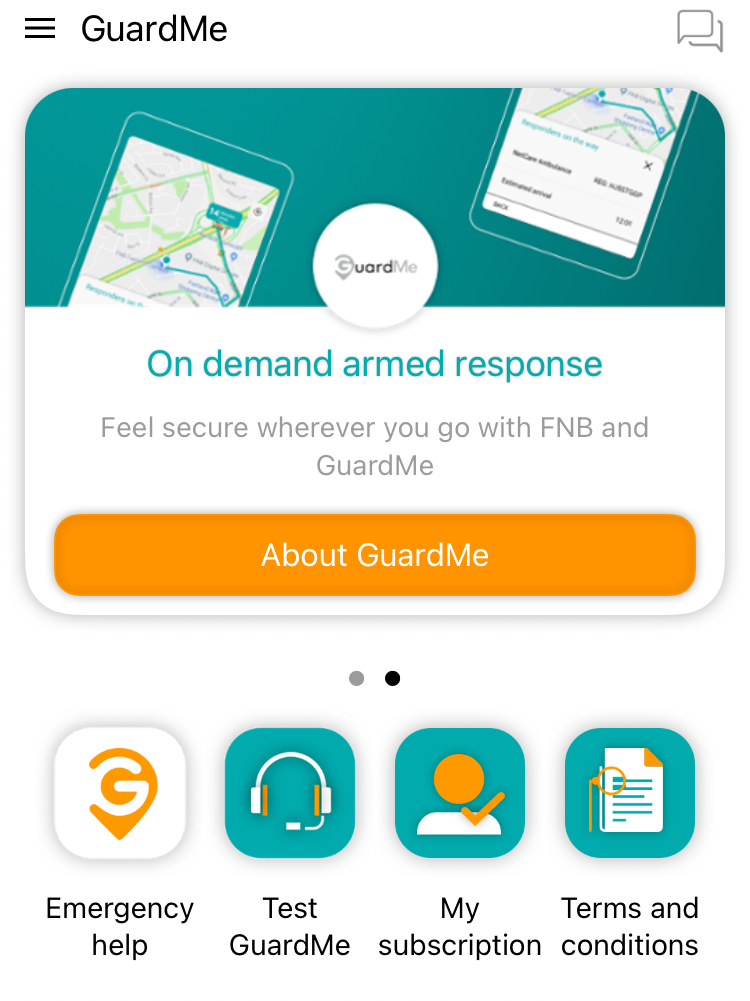

GuardMe emergency app

GuardMe is a panic button and emergency response service powered by Aura. FNB has partnered with the company to provide an in-app panic button for FNB customers.

The service can be activated by selecting the “GuardMe” option in the eBucks section of the FNB or RMB App.

The panic button requests help from the nearest emergency response vehicle using auto-dispatch technology.

Through the partnership, the first three months of the service is free for customers. Afterwards, it costs R19.90 per month per user.

You can add up to six members to the GuardMe subscription. This allows you to add friends or family who don’t bank with FNB or RMB to the service.

Starbucks free coffee

Another new eBucks rewards partnership announced by FNB is one with Starbucks. Through the partnerships, FNB and RMB customers can get a free coffee or hot beverage (up to the value of R37) once a week.

In order to qualify though, you need to complete five FNB Pay or Virtual Card transactions weekly. When you do this, you will receive a virtual voucher in the banking app which you can scan at the till at Starbucks.

These vouchers will be available under the “My Benefits” section within the eBucks tab in the app.

FNB eBucks Games

eBucks Games is a new platform that allows users to play a selection of games with no ads or popups. You can use your eBucks to pay for coins, which can then be used to enter tournaments.

There are both free and paid games on the platform. FNB also notes that you can add other members to your profile even if they aren’t bank customers. You are also able to access the platform with different devices, though it is optimized for mobile.

You can join the platform through the “Games” icon on the FNB or RMB App.

In addition to these new platforms and partnerships, FNB also announced the launch of its new “Hero Device Deals” on its FNB Connect platform.

The platform lets you buy tech using the FNB App with specific deals and contracts for bank customers.

Read more: MTN launches ‘Learn with Oxford’ platform for high school learners