Forget chatbots and robo-advisors, Absa just introduced an AI-powered digital clone of award-winning journalist Fifi Peters, and it’s rewriting the rules of what’s possible…

Repo increase 2023: Here’s what you need to know

An increase in the repo rate by 25 basis points is not the best news for consumers, yet could be an opportunity for smart investors to diversify their investment portfolios according to Sisandile Cikido, Nedbank’s Head of Retail Investments.

The repo rate means an interest rate hike which translates to the loans you have being more expensive.

The definition also means the interest banks pay on certain investments will most likely be more signaling a higher interest rate cycle.

“A higher interest rate cycle is the ideal opportunity to take out an investment that would lock in that rise over the medium to longer term, because in due course, interest rates will go down again”, says Cikido.

The repo rate impacts the interest rate at which banks will lend which then translates to an impact on the cost of your home loan.

It was at its lowest during the pandemic but there has since been a succession of increases by the South African Reserve Bank.

At 6.25% is the current repo rate with the prime lending rate sitting at 10.5%.

Recent increases:

- 0.25% in November 2021

- 0.25% in January 2022

- 0.25% in March 2022

- 0.50% in May 2022

- 1.50% in September 2022

- 0.75% in November 2022

Why the increase?

It was during the pandemic that the South African Reserve Bank attempted to stimulate the economy and now they’re adjusting for inflation.

Cikido emphasis that certain term investment accounts including notices tend to offer higher interest rates after an interest rate hike, “when the interest rate is high, opening an investment account is a way of locking in that benefit, even when the cycle turns.”

Diversification should be a key principle of any investment portfolio.

“A fixed-rate or term investment involves investing money for a specific number of months. During that time, you cannot access your money without being charged a penalty fee.

“And to maximize growth, you should capitalize the interest that you earn. It’s also wise to have money in an account with a variable interest rate that you can access quickly in emergencies,” she says.

The Covid19 pandemic proved two things, one that we need money quickly in the case of an emergency and two a crises can strike at any time.

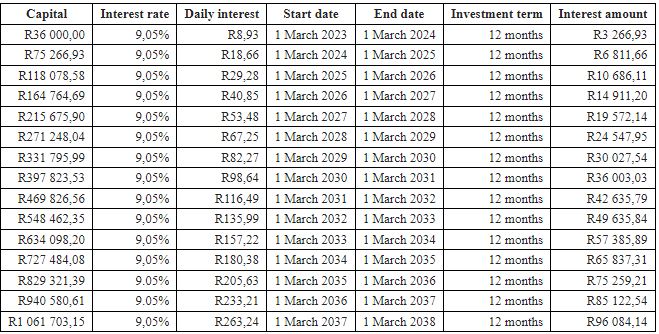

The table below illustrates how your money can grow if you invest it in a Nedbank 12 months Tax-Free Fixed Deposit available to South Africans to take advantage of the higher interest rate depending on how much you invest.

Nedbank also has a digital feature which enables non Nedbank clients to apply for investments accounts on the Nedbank Money app and Online.