South Africa’s retail forex industry is entering a decisive phase as regulation tightens and consolidation accelerates. What does it mean for brokers and traders?

The evolution of payment systems, the next wave of secure options

Payment systems and how consumers make payments for the items they want may see more additions come 2024, thanks to accelerated machine learning coupled with artificial intelligence.

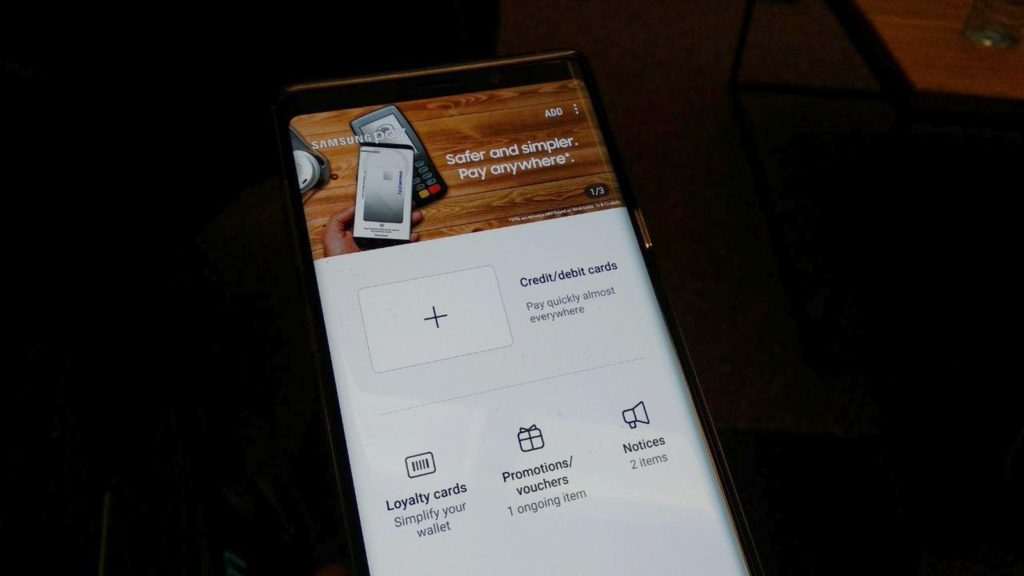

Things could move very quickly from traditional card payments, paying using QR code scans, mobile wallets in the form of Google Pay, and other electronic fund transfers, thanks to accelerated AI advancements and the tech rapidly evolving landscape.

When looking at decades before the Covid 19 pandemic we can track how vast the payment landscape has mushroomed to see remarkable changes.

From financial tech firm Paystack, Joel Bronkowski, shared some insight with us in exploring how the aid of AI and machine learning could mean new things come 2024 and beyond and this could spell better options for consumers.

Payment solutions to date are vast, different and cater to a myriad of businesses. While all payment solution offerings remain advanced with a fleet of benefits such as the addition of AI, biometrics, and voice payments, it’s solidly clear that come next year, better solutions in the form of payment solutions may make headway.

Financial firm Price Waterhous Coopers (PwC) research indicates a 42% growth in cashless transactions by 2025, with Asia-Pacific being the lead at 109%, followed by Africa which may see a 78% gain between now and 2025.

The predicted theory is that cashless payment options are set to increase by more than 80% between 2023 and 2025 moving from around a trillion deals to almost 1.9 trillion.

Shoppers have become accustomed to shopping online since the Covid19 pandemic and this steadily continued to grow.

Research between MasterCard and World Wide Worx indicates that online retail in the country expanded and is now worth more than R 50 billion, a more than 30% growth.

“While still a small percentage of overall retail sales, which were R1.2 trillion last year, the gains in online shopping show that this is the place to be,” says Bronkowski.

“The surge in the web-based environment offers great opportunities for entrepreneurs who are seeking to expand in an increasingly tenacious and economically difficult environment.”

He adds that growth in payment systems and their simplicity of use for consumers and merchants alike means that one of the hurdles of setting up an online shop, such as the costs involved, as well as shipping products, is removed.

Payment technologies are clearly evolving to meet the everyday demands of the everyday evolving consumer, with this in mind, it’s clear to see how the country has evolved since the days when e-commerce first made its tentative steps in the 1990s when credit cards were one of the few options of payment available.

Electronic fund transfers gained traction in the late 1990s and early 2000s followed by other payment gateways which made it a lot easier for online merchants to accept payments in general.

Fast forward to 2010 and mobile payment systems had matured in development with little fear associated with them from the end consumer.

That same decade also witnessed the growth of instant EFTs, which offer a seamless and secure way for customers to make online payments directly from their bank accounts. More recently, digital wallets, and cryptocurrencies, and services have come to the fore, further expanding space.

Bronkowski adds that there will likely be a shift forward, which we agree with, past our current favourite payment systems such as Apple Pay, Google Pay, and Samsung Pay.

Yes, some payment systems may be in their infancy stage in other countries, but it’s apparent that payment systems are on an upward trajectory in terms of demand.

Another contender for revolutionizing the way we shop and sell online is a Blockchain-based payment system.

With innovative solutions must come the cons and it means hackers will likely get smarter, but so will payment systems if you look at it holistically, they will have to.

“Many banks are now also making use of biometrics for their customers to log into the app, either through fingerprint identification or facial scanning,” says Bronkowski. Voice commands, too, will be playing a role in checking out online in the not-too-distant future, he says.

“As technology continues to evolve, so too will payment processes, making the online world not only a safer place to shop, but also more convenient for consumers and online merchants as well. These advances will also be spurred on by the online retail environment’s growth, which will boost the opportunities for those who want to get into this space,” he said.

Also read: Huawei ICT academy awards ceremony, here’s what happened